I might have a new house! I don’t like putting the address in the article, where it will easily appear on a search. However, I want you to follow along and know the actual house, so look at its qPublic page or its Zillow entry. Please note the pictures on the Zillow page are the wrong house.

How I Found It

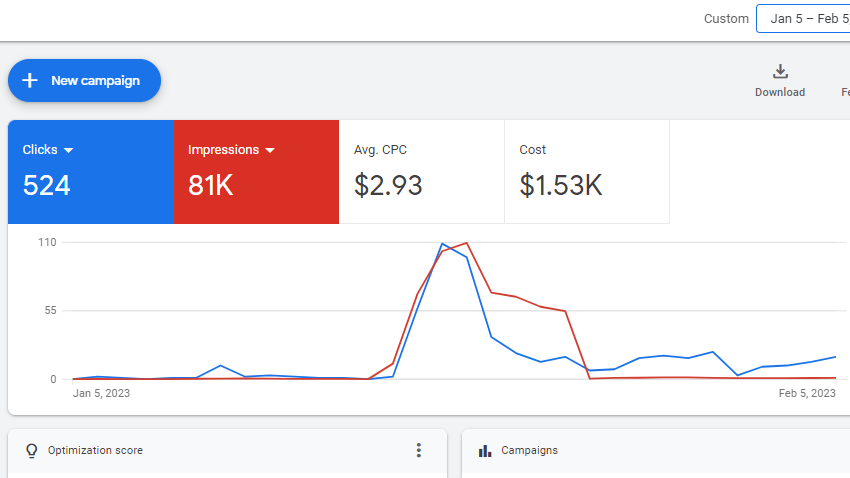

This house was found from a lead on my webpage. In the 30 days before getting this lead, I spent over $1,500 running google ads. This generated several leads, but most properties were outside the area where I invest. Some others were in the right location but didn’t have enough equity to lead to a deal.

My manager contacted the lead and found out they had moved out of town and rented the house. The tenant is moving, and the owner doesn’t want to do any work on the house. He wants to sell it as easily and quickly as he can.

My manager went to the house and made a quick repair estimate. She makes a rough estimate we can use for negotiating, not a detailed punch list for a contractor to work from. This article will teach you how to make a repair list for an investment house.

The Numbers

The house doesn’t need a lot of work, and I estimate the renovation budget to be about $9,600.

- $1,100 – install tile flooring in the kitchen.

- $2000 – Paint the interior of the house.

- $3,000 – recarpet the bedrooms.

- $500 – Remove the hot tub from the deck.

- $500 – Pressure was deck and fence.

- $1,000 – Paint the deck.

- $1,500 – The miscellaneous work is listed below.

- Repair ceiling fan in a bedroom

- Remove the peel-and-stick backsplash behind the stove.

- Replace the cabinet door in the master bath.

- Install wood trim around the post by the front door

- Replace screening and rotten wood around the back porch and dec

The Zillow value for the house is $166,400, while ProSteam estimates a value of $174,006. I spoke with a real estate agent familiar with the area, and he is confident the house will sell for $190,00. I will base my numbers on the lower value but hope to get the higher value when I sell. The table below shows the numbers I am working with. The table below shows the numbers I am working with.

| Asking Price | $120,000 |

| Renovation Cost | $10,000 |

| After Repair Value (ARV) | $166,400 |

| Market Rent | $1500 |

I aim to purchase flip houses at 70% of the after-repair value. Using a value of $166,400, I calculate that I should invest no more than $116,480 in this property. I may be open to paying a little more because my agent seems confident I can sell this for $190,000. However, it’s always best to base your decision on the lower numbers.

I instruct my manager to offer $105,000. It takes her a few hours to get in touch with the customer, but eventually, he accepts the offer. We agreed to a verbal deal with no earnest money; I sent the information to the attorney and asked him to rush the closing.

Next Steps

We now have a verbal agreement, and the attorney is about to start the title work. Our goal is to lose on this house by February 20th. I plan to finance this purchase using the HELOC on my personal residence, which is at 2%.

Update: Crestwood has closed.

Pictures