A real estate closing statement, also known as a settlement statement, is a document that provides a detailed breakdown of the financial transactions involved in the transfer of real property. This article will use an example real estate closing statement and explain each line in detail.

It will be prepared by the closing real estate attorney or title company and given to all parties of the transaction. This settlement sheet will provide a comprehensive list of every expense included in the real estate transaction.

The closing statement is one of the many legal forms used for a home purchase. It itemizes all the costs, fees, and expenses related to the real estate transaction. This detailed list of every fee will include the purchase price, loan amount, prorated taxes, insurance premiums, recording fees, and any other expenses involved in the transfer of ownership.

The closing statement will specify who is responsible for paying for each item. It will also include the total paid to, or received from, the buyer and the seller. On the day of closing, all parties involved in the home sale will sign this statement at the closing table.

The HUD-1 Closing Statement

The HUD-1 settlement statement, published by the U.S. Department of Housing and Urban Development (HUD), is required, by federal law, for mortgage transactions that are subject to the Real Estate Procedures Act. This applies to most mortgages, including refinances and reverse mortgages. All the details of a financial transaction will be captured on the HUD-1.

A HUD-1 statement form is not required for all real estate transactions. It is not required for cash sales or certain commercial real estate transactions. However, the HUD-1 form is often used even when not required. Therefore, it’s an excellent resource for a real estate closing statement example.

Why Use The HUD-1 When It’s Not Required?

A HUD-1 form provides a concise overview of the financial aspects of the transaction, ensuring transparency and clarity for all parties involved. This form includes the property information, buyer and seller information, sales price, loan information, settlement charges, prepaid items, escrow account details, adjustments, and credits. It will also include the final figures summarizing the amounts due from the buyer and received by the seller.

Where Do I Get the Hud-1?

The most recent HUD-1 version can be downloaded as a fillable pdf.

Why is a Closing Statement Needed?

The purpose of the closing statement is to ensure transparency and provide a clear understanding of the financial aspects of the transaction.

The closing statement helps both parties verify that all agreed-upon terms, costs, and credits are accounted for. This document serves as a record of the financial transactions and helps facilitate the transfer of funds between the parties involved in the real estate transaction.

Understanding the Closing Statement

Most closing statements include the same information, with slight variations in format. The most frequently used closing statement is the HUD-1 because it is required in many situations. I will use the HUD-1 as the example real estate closing statement in this document, but most of this information will apply to other closing statements.

Note: On the HUD-1, the buyer is called the borrower whether a loan is used or not. This article will use the words buyer and borrower because we intend to use the HUD-1 as an example of a real estate closing statement.

The HUD-1 Closing statement has two columns. Home buyers will find their information on the left side of the settlement sheet. The right side will have the details for the home seller.

The first page of the HUD-1 closing statement includes the property information, personal information, and a list of all transaction costs. On page two, the form will show the broker’s fees and a detailed list of all the closing costs.

When a mortgage loan is used, the third page of the form includes information about calculating the good faith estimate (GFE). This article is about closing statements in general and will not include details about the GFE.

This article will use the HUD-1 as an example real estate closing statement and explain each section. The information on the HUD-1 form should be on any real estate closing statement.

Note: The line numbers may vary between closings.

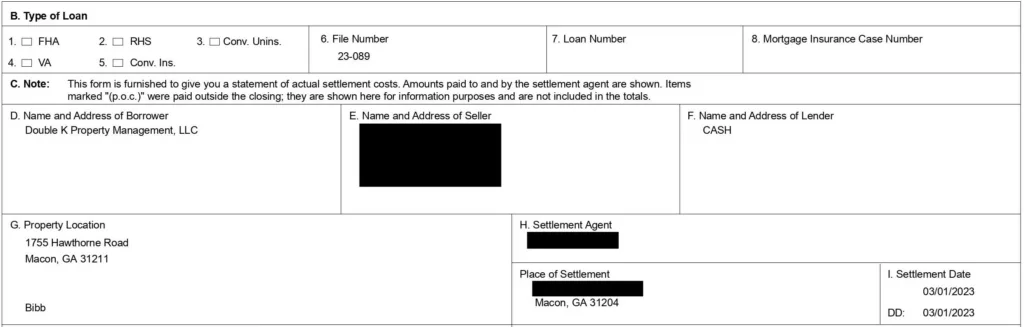

Transaction Overview

Page one begins with an overview of the transaction. It includes the type of loan used, if any, along with the name and address of any mortgage lender. In addition, this section will consist of the address of the property, the parties involved, and the settlement date (the date the transaction occurred).

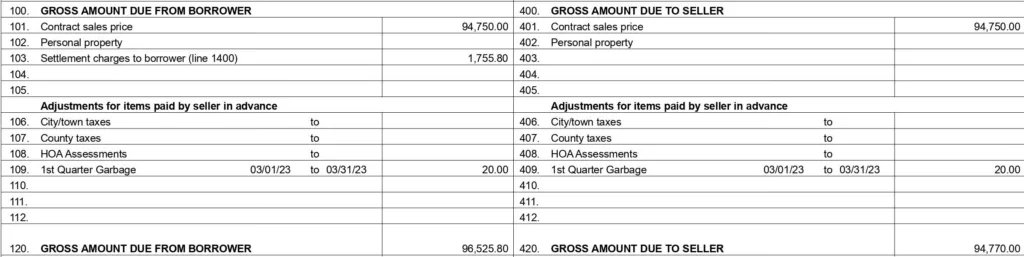

gross Amounts Due

Buyer/Borrower

Section 100, on the left side of the closing statement, is the gross amount due from the buyer, called the borrower on this form. This is the total amount the buyer has to pay at closing.

In the example closing statement above, from line 101, the buyer is paying $94,750 for the property. They are also paying $1,755.80 in settlement charges (line 103), which are closings costs. In addition, the buyer is paying $20 for garbage fees (line 109).

In total, the buyer is paying $95,525.80 (line 120).

Seller

Section 400, on the right of section 100, represents the gross amount due to the seller. This is the total amount the seller will receive before factoring in any adjustments.

In the example closing statement above, from line 401, the seller is selling the property for $94,750.00. They are also paying $20 towards the garbage bill. That is, the buyer and seller are splitting the garbage fee.

In total, the seller will receive $94,770.

Remember, this is the gross amount. The net will be determined in the remainder of this form.

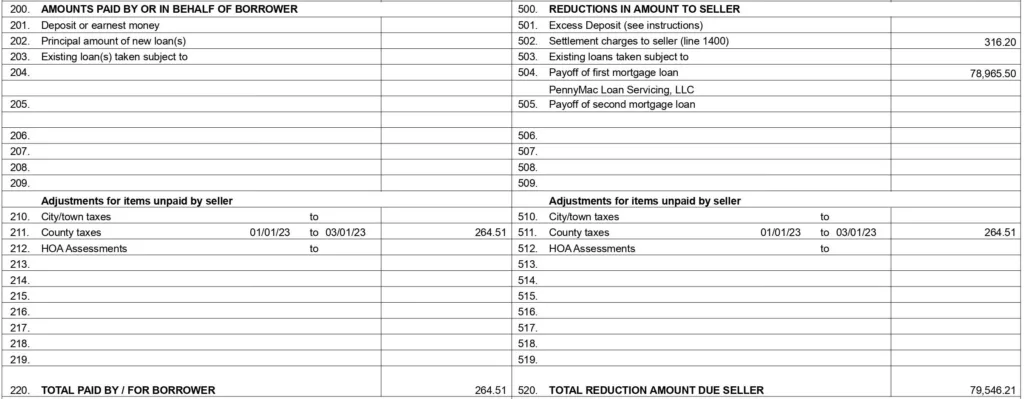

Amounts Paid/Reductions to Seller

Before delving into this section, all parties must understand prorated taxes and fees.

Prorated taxes in a real estate transaction refer to the division of property taxes between the buyer and seller based on the time of ownership during the tax period. The taxes are calculated proportionally, taking into account the closing date and the duration of ownership by each party. This ensures that each party pays their fair share of the property taxes for the period they owned the property.

Buyer/Borrower

Section 200, on the buyer’s side of the closing statement, shows anything already paid by the borrower. In the example above, nothing has been paid in advance. Line 201 would include any earnest money paid.

Anything already paid by the buyer or someone else on the buyer’s behalf will be recorded in this section.

The lower portion of this section includes adjustments made to cover items the seller should pay. In this case, the prorated country taxes of $264.51 will be subtracted from the gross amount due from the borrower.

In this case, the seller should have been responsible for a small amount of property taxes for the time they owned the property. The taxes have not been paid, so the buyer must pay them. This adjustment gives the buyer credit for the taxes they will have to pay.

As reflected on line 220, the buyer must pay $264.51 less than the gross amount due from the borrower on line 120.

Seller

Section 500, on the seller’s side of the closing statement, shows anything the seller will owe. This will take the form of a reduction in what the seller will receive after closing.

In the example closing statement above, line 502 is $316.20. This is the prorated sewer charged from the time the seller occupied the property. It will be with help from the seller and paid to the appropriate utility agency.

Line 504, with an amount of $78,965.50, shows the loan payoff the seller must make to provide a clean title. This amount will also be deducted from the gross amount and paid directly to the lender.

Line 511 is the $264.51 adjustment the seller must contribute towards prorated property taxes. Instead of paying it directly, the seller received a deduction from the final amount they would receive.

As reflected on line 520, the seller will receive $79,546.21 less than the gross amount due to the seller on line 420.

Cash From/To

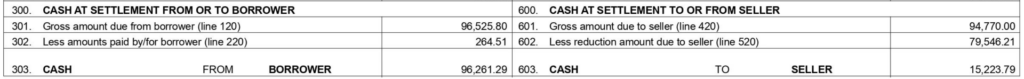

Buyer

Section 300, on the left buyer’s side of the closing statement, will give the amount the buyer must pay into escrow. This is often more than the seller will receive because a portion goes to lien payoffs, taxes, and fees.

Line 301 is the gross amount due from the borrower on line 120. Line 302 is the amount already paid by the borrower, which is subtracted from the gross on line 301.

In this example closing statement, the borrower (the buyer) must pay $96,261.29 into escrow.

Seller

Section 600, on the right seller’s side of the closing statement, will show the amount the seller will receive from escrow. This is typically lower than what the buyer pays because a portion goes to lien payoffs, taxes, and fees.

Line 601 is the gross amount due to the seller from line 420. Line 602 is the reduction due to the seller from line 520.

In this example closing statement, the seller will receive $15,223.79 from escrow.

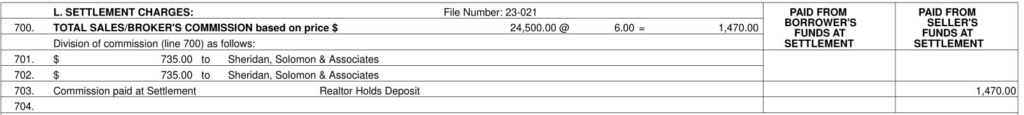

Broker Commissions

This is an example of broker commissions. Please note this is not from the same closing statement as the other examples. The intent is to provide an example real estate closing statement; the primary example didn’t involve an agent. Therefore, there were no broker fees.

The broker commissions section will break out the fees paid to the real estate broker. The broker is who the real estate agent works for, and this agent is paid out of the broker fees. In the example above, line 701 shows the amount paid to the seller’s agent, and line 702 shows what the buyer’s agent is paid.

In this case, the buyer and seller used the same agent, and the seller paid the commission out of their proceeds. There is a total of $1,470 in commissions paid.

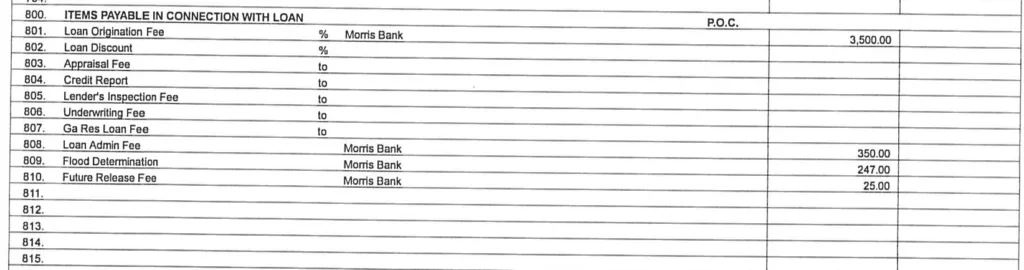

Loan related Payables

Section 800 includes the items payable in connection with the loan. Please note this is not from the same closing statement as the other examples. The primary example didn’t have a mortgage involved. Therefore, there were no loan charges.

This section will include the costs for appraisal fees, credit report charges, and various loan-related expenses.

In most cases, section 800 will only have data for the buyer’s side (the left side). However, in some cases, the seller may contribute closing costs to the mortgage. When the seller pays for some of the loan costs, they will show in the right-hand column.

In this case, shown in line 801 above, the buyer paid loan origination fees of $3,500. In addition, line 808 shows an administration fee of $350 was charged. Lines 809 and 810 include other lender fees.

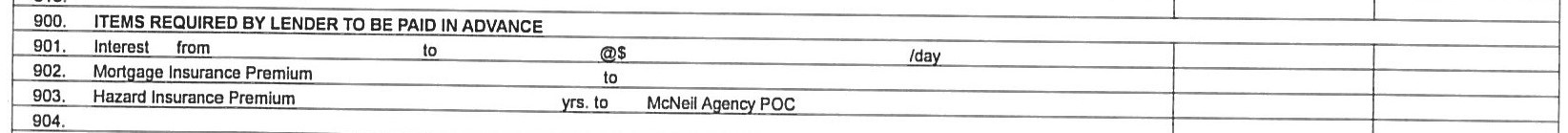

Lender Items Paid in Avance

Section 900 includes the lender items that must be paid in advance. In this case, line 903 shows that an insurance premium has been paid. However, it was paid in advance outside of closing. Therefore, no numbers are in this section.

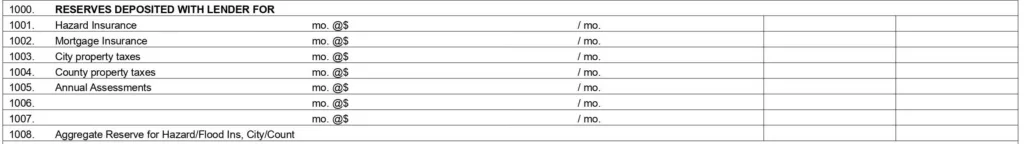

Reserves Deposited with Lender

Section 1000 of the HUD-1 closing statement is for the reserves deposited with the lender. In the case above, there were no reserves deposited for the lender.

The lender’s reserves cover expenses such as local taxes and private mortgage insurance premiums (PMI). These expenses are usually the buyer’s costs, but the seller may contribute to them.

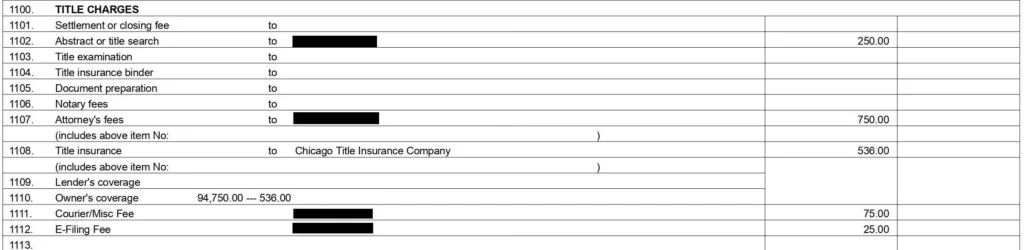

Title Charges

Section 1100 provides a breakdown of the total settlement charges for the buyer. It includes a detailed itemization of all the fees and expenses the buyer must pay at closing. This section typically includes attorney fees, title search fees, and title insurance fees.

In the example above, line 1102 shows that the buyer paid $250 for a title search. Line 1107 is for the attorney fees, which were $750. In addition, the buyer purchased a title insurance policy for $536. Line 1111 and 1112, and for the courier and e-filing fees.

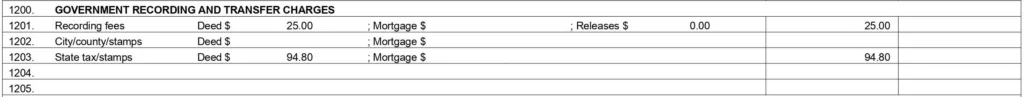

Recording

Section 1200 includes the government fees for recording the transaction and updating the public records. This example shows a $25 fee to record the new deed (line 1201) and a cost of $94.80 for the state tax (line 1203).

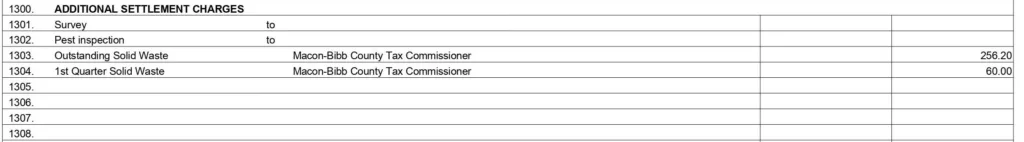

Additional Charges

Section 1300 records various fees and additional charges not found elsewhere on the form. In this case, those charges are for county solid waste charges. $256 was an outstanding balance from previous quarters, and $60 is for the current quarter.

Details Total

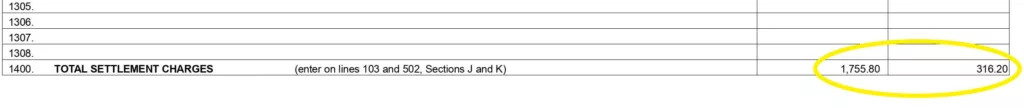

Line 1400 is for the total settlement charges. This is the total of the detailed breakdown on the second page. In this example, the buyer is paying $1,755.80, and the seller is paying $316.20.

The buyer’s total of $1,755.80 on line 1400 should match the total settlement charges in section 100 (line 103 in this case).

The seller’s total of $316.20 should match the settlement charges in section 500 (line 502 in this case).

Conclusion

This article has detailed every item on a real estate closing statement. Using an example settlement statement, the article explained each line item a buyer or seller would encounter.

Before the closing, the buyer and seller should ask for a preliminary copy of the settlement statement. This gives all parties ample time to study the charges and ask questions.