This article will show you exactly how real estate investors run the numbers on a rental house, and it’s written by an actual rental property investor who has to run the numbers to survive. Real estate investing can be lucrative but easily become ruinous if you make mistakes calculating the numbers. I have been investing in real estate for more than 15 years, and I currently have 70 properties and own a property management company. I know which numbers matter and the key ratios to succeed.

Investors run the numbers to calculate the ROI, Cash-On-Cash return, cap rate, and cash flow for rental properties. By analyzing these metrics, investors can determine if an opportunity will be profitable and make informed decisions about whether to invest in the property.

There is more to it than just making the calculation. An investor must know why these numbers are significant and how they impact rental property investment. I will teach you everything you need to know to run numbers for a rental property and to make a good investment. After that, I’ll share some numbers from a house I bought last week.

Key Terms for Rental House Numbers

In this section, I will define terms you must understand before seeing how real estate investors crunch the numbers on a rental property.

Rent

The monthly rent, the amount a tenant will pay to live in the property, is the driving number. The house is going to rent for what rent the market allows. You cannot adjust the rent to fit what you spend, so you must base your decisions on what the rent will be. I have written a detailed article that will teach you how to determine market rent accurately.

Acquisition Cost

The acquisition cost is what you pay for the property after including all the costs to purchase and make that property available for rent. This is not limited to what you buy the rental house for. You must include the closing costs and any renovation costs. For a single-family home, the work required to make the property rent-ready is a significant portion of the total acquisition cost. I have purchased houses for less than what it costs to renovate them.

Operating Expense

The ongoing operating expenses of single-family homes are an essential metric when determining what you can pay for a property. These expenses include property taxes, repair costs, property management fees, and capital expenditures. You must learn to estimate these expenses accurately.

Fortunately, there is a handy formula that is surprisingly accurate. Over the long term, operating expenses tend to be about 40% of the rent. Academic studies have shown this to be accurate, and my books show a similar number over my investing career. I have an article that devels into this topic in detail and explains how to predict rental operating expenses with surprising accuracy.

Property Value

The fair market value of a piece of real estate. The value of a real estate property is determined by various factors such as its location, size, age, condition, and the current real estate market supply and demand.

Net Profit

The net profit, or net income, produced by a rental property is the amount earned after all expenses are paid. This is the rent collected minus all operating expenses, mortgage interest, and taxes. Mortgage principal payment is not an expense but a cash transfer to equity. To run the numbers on a potential investment, do not include property depreciation in the net profit calculation. However, depreciation is usually included in net profit for income tax purposes: Go Rentals!

Essential Metrics for Real Estate Investors Crunching the Numbers

When investing in rental properties, there are several significant numbers to know, and calculating these metrics is what running the numbers is all about. In this section, I’ll explain the most important numbers, show you how to calculate them, and give a glimpse into how real estate investors crunch the numbers.

ROI

The ROI, or return on investment, is a critical metric that can be used to determine how profitable an endeavor is. The ROI is the net profit, your income minus expenses, divided by the house’s acquisition cost. Thus, if you spend $100,000 to acquire a property, and your net annual profit is $10,000, you have an ROI of 10%.

ROI = (netProfit ÷ acquisitionCost) x 100

Important Point! You can control the ROI by adjusting the purchase price. If you want a higher ROI, pay less for the house, or wait for a good deal to come along.

Cap Rate

The cap rate, or capitalization rate, is the rate of return you receive on your capital investment. That capital investment is simply what you paid for the property; the acquisition cost. The cap rate calculation is as follows:

CapRate = (netProfit ÷ propertyValue) x 100

The cap rate is not the same as the ROI. The cap rate uses the property’s value, while ROI uses the acquisition price. Cap Rate is generally used with commercial properties, while ROI is more common when discussing single-family rentals. A high cap rate will produce higher returns, and it’s best to avoid a lower cap rate unless there is another reason for investing. I have included both because you will hear both terms during your investment career.

Cash-On-Cash Return

The Cash-on-cash return is a measure of profitably on the cash you put into a real estate deal. This metric does not use the acquisition price of the property and does not include a mortgage. In most cases, this is the return on your receive on your downpayment. When you pay cash for the property, your cash-on-cash investment is equal to the ROI. When calculating the Cash-on-cash return, you must also deduct the loan principle payment (the interest payment is already removed from net profit), so you use cash flow instead of net profit.

Cash-On-CashReturn = (cashFlow ÷ cashInvested) x 100

GRM

The GRM, or Gross Rent Multiplier, is a metric used to estimate the value of an income-producing property. It is calculated by dividing the property’s sale price by gross rental income. A lower GRM indicates that the property generates more income relative to its sale price and thus may be a better real estate investment opportunity.

GRM = acquisitionCost / annualRentalIncome

In place of the GRM, the investor may calculate the MGRM (Modified Gross Rent Multiplier), a similar formula that uses the monthly rent.

MGRM = acquisitionCost / monthlyRentalIncome

Net Present Value

Net Present Value (NPV) is more complicated to calculate. It measures the current value of money you expect to receive, adjusted for the time value. The basic idea is that money is worth more now than in the future because it can be invested to earn interest.

NPV = Rt/(1 + i)t

Rt is net cash flow at time t.

i is the discount rate

t is the time of the cash flow

To put it simply, calculating NPV involves figuring out how much money you expect to make or spend in the future, accounting for the fact that money is worth more now than it will be in the future, and then adding up all of those amounts to determine whether the investment is expected to be profitable or not. Net present value is rarely used when real estate investors crunch the numbers.

IRR

IRR, or the Internal Rate of Return, is the interest rate at which the net present value (NPV) of all cash inflows and outflows from an investment project equals zero. In other words, it is the rate at which the sum of the present value of future cash flows equals the initial investment or the cost of the property.

Cash Flow

Cash Flow is the most critical metric for being a successful real estate investor. Rental property cash flow is the amount of cash (or equivalents) moving in and out of your rental business. To be a successful investor, you seek out investment properties with positive cash flow.

Cash Flow It’s not the same as net profit. Suppose you buy a doorknob with a credit card. You immediately incur the expense of the doorknob, and your profit goes down. Your cash flow is not affected until you make the payment on the credit card, and then your cash goes down. This is significant because large capital expenses dramatically affect cash flow, but these costs may be depreciated over several years and have a negligible impact on net profit. It’s possible to have a nice net profit but a negative cash flow. On top of that, taxes usually apply to the net profit and not the cash flow. Ouch!

A Real-World Example of Running the Numbers

I came across a house in terrible condition that the owner wanted to get rid of. After looking at the property, I determined it needed $30,000 in repairs. I have houses in the area, so I am already up to speed on property values and rent amounts. I knew that once renovated, the home would be worth about $95,000 and rent for about $1,150 per month. Also, I know that operating expenses will be about 40% of the rent.

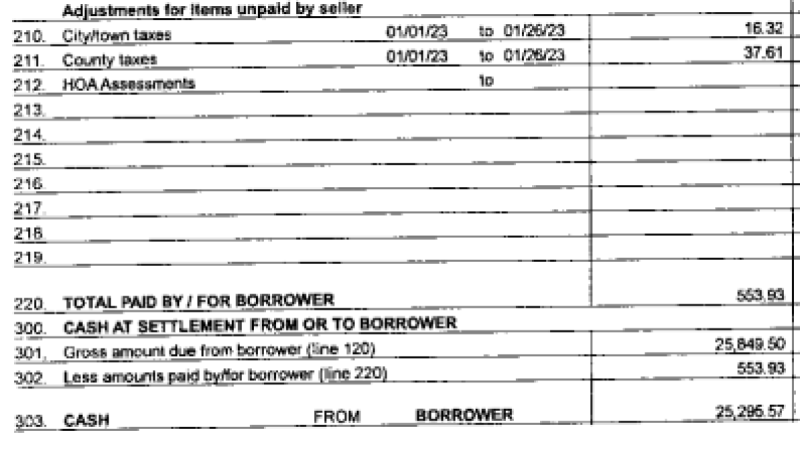

After some negotiation, we arrived at $25,000 for the house, which gave me an acquisition cost of $55,000. When the renovation is complete, I will borrow against the home to replenish my cash for another deal. When I refi, I will sink $11,000 (20% of the acquisition cost) into the deal and refi $44,000 at 8.25% on a 15-year amortization commercial loan with a monthly mortgage payment of $418.

| Acquisition Cost | $55,000 | Purchase price + repair costs |

| Annual Rental Income | $13,800 | Monthly rent time 12 months. |

| Annual Operating Expenses | $5,520 | 40% of the rent |

| Annual Mortgage Interest | $3,205 | First years interest on the loan |

| Annual Loan Payments Total | $5,016 | Note this number includes the Annual Mortgage Interest above. |

| Annual Net Profit | $5,075 | Annual Rent – Annual Operating Expenses – Annual Mortgage Interest |

| Annual Cash Flow | $3,264 | Annual Rent – Annual Operating Expenses- Annual Loan Payments Total |

| One-Time Down Payment | $11,000 | The downpayment on the loan. |

Using the data in the table above, I can calculate these key metrics.

ROI and Cap Rate

ROI = (netProfit ÷ acquisitionCost) x 100

ROI = (5,075 ÷ 55,000) x 100 = 9.231455

CapRate = (netProfit ÷ propertyValue) x 100

CapRate = (5,075 ÷ 95,000) x 100 = 5.34%

This deal has an ROI of 9.23% on all money invested. However, its cap rate is only 5.34%. If I can find an investment paying more than 5.34%, I should sell this property and move the funds into that asset. Remember, if I sell the house, I should get its local market value which is higher than the acquisition price. In practice, there are other factors to consider, such as income taxes, mortgage balance, and transaction costs.

Cash-on-Cash Returns

Cash-On-Cash Return = (cashFlow ÷ cashInvested) x 100

Cash-On-Cash Return = (3,264 ÷ 11,000) x 100 = 29.7%

The cash-on-cash return is 29.7%. This means I am getting a 29.7% on the down payment, which is the money I must invest. If I could make more than 29.7% with another investment, it may be better to use my down payment for the other investment. However, a return of nearly 30% is hard to beat.

Cash Flow

Monthly Cash Flow = (annualCashFlow÷ 12)

Monthly Cash Flow = (3,264÷ 12) = $272

Cash flow is simple. It’s just the money left over after paying all your obligations and setting aside funds for future maintenance. Accurately performing a cash flow analysis on potential investment is the most important metric. Without a reliable annual cash flow, the property will likely become a drain on your resources. Be sure to include cash flow when you run the numbers on a rental property.

GRM

GRM = acquisitionCost / annualRentalIncome

GRM = 55,000 / 13,800 = 3.99

In this case, the GRM of the property above is 3.99. To simplify this calculation, I use the MGRM (Modified Gross Rent Multiplier), which calculates the GRM on a monthly basis.

MGMG = 55,000/1,050 =52.39.

Net Present Value

Net present value involves discounting cash flows. For that, we have to estimate the returns of the investment property in the future and then apply a discount. That discount gives us the money we would need to invest now, at a given interest rate, to have it grow to the value we will receive in the future. That interest rate is called the discount rate, which we could get for a stable investment.

For example, assume you can get a rate of 5% with a bank certificate of deposit. We will use 5% as the discount rate. If we could make $1,000 in one year, how much would we need to invest at 5% to make that $1,000?

NPV = Rt/(1 + i)t

NPV = 5,0751/(1 + 0.05)) = $4,833.33

If we invest $4,833.33, at 5% apr, for one year, we will have $5,075.

In the second year, assume we will have precisely the same return.

NPV = 5,0752/(1 + 0.05)2 = $4,603.18

Notice the value we need to invest now is more because it takes us two years to get the $5,075.

We add these two values together; 4,833.33 + 4,603.18 = $9,436.51, setting the net present value of the property at $9,436.51.

In reality, it’s more complicated because you will continue to receive returns for many years, with each year having a lower present value. For this reason, we have to discount cash flows for an infinite number of years. In addition, you will have an appreciation, and your monthly rent will change.

Discounting cash flows and calculating net present value is complex and depends on predictions that will not be accurate. You are paying too much for the property if you have to calculate the net present value—most real estate investors do not calculate net present value when they run the numbers.

IRR

Calculating the internal rate of return is beyond the scope of this article. It requires accurate predictions and calculus to perform the calculation. IRR is rarely used when real estate investors crunch the numbers; it’s more often used for attracting partners to large commercial projects. For details, read this article on calculating the IRR, or use this online rental property calculator to determine your IRR.

Key Takeaways

It is critical for real estate investors to run the numbers on a rental property accurately. Mastering this skill enables you to make informed investment decisions and manage your investments wisely. This article has shown you how to calculate ROI, Cap Rate, Cash-On-Cash Returns, and Cash Flow. While you should know how to produce all these metrics, Cash Flow is the most important. Having free cash flow is what allows you to respond to emergencies and continue to grow your residential property portfolio.

When evaluating a rental property, I start with the MGRM, the monthly version of the GRM. If the MGRM exceeds 50, I will not consider the property a potential deal. Before considering it a good deal, I must get the property below 50 times the rent, a 50 MGRM. If the MGRM is below 50, it warrants a closer look, and I may run the other numbers on the rental property. The most important thing to remember is to never pay too much for a rental property. You can only do that if you know how to run rental property numbers.