You’ve got your first rental house and have no idea how to manage rental property effectively. I have been managing my own rental houses for over 15 years, and I’ve developed a process that reduces the hassle and time commitment required. I will teach you the method I used when I had one house, which I refined as my portfolio grew to over 70 properties.

There are five simple steps to manage your rental property effectively. Determine the market rent, market the property to prospective tenants, handle maintenance and repairs, collect the rent, and deal with non-paying tenants.

Managing your rental property is not difficult if you have a plan from the beginning. There is no need to use a property management company; you can do this yourself. This article will teach you how to easily implement the five steps to managing your rental properties.

1. Determine Market Rent

Set the right Rent

The first step to managing rental property effectively is setting a fair market rent. This is essential because it helps property owners to maximize the profitability of their real property investments. The market rent is the amount that can be charged for a particular property based on the current market conditions, such as the demand for similar properties in the area, the availability of rental units, and the local economy.

By setting a market rent that aligns with the current market conditions, property owners can attract tenants willing to pay the rent and maintain a steady flow of rental income. Setting a rent that is too high can result in long vacancy periods, which can lead to a loss of rental income and additional expenses for the property owner. Conversely, setting a rent that is too low can result in missed opportunities to maximize the return on investment and can result in lower profits.

Don’t fall into the trap of thinking your house is special and will rent for more than similar properties in the same area. If you need help accurately determining the market rent, check out my guide, which teaches you how to determine the true market rent. Once you know the rent, it’s time to market the house.

2. Market The House

Make sure tenants see the house before you are involved.

Marketing your rental house effectively is vital to attracting prospective tenants and ultimately finding the right tenant for your property. The best way to market most rental properties is by putting a “For Rent” sign in front of the house. There is no need to use other market techniques unless this fails, and this method rarely fails.

The reason for using the “For Rent” sign as your primary marketing approach is that it ensures the tenant has seen the house and is aware of the neighborhood. Other marketing methods lead to wasted time showing the house to candidates that don’t like the house’s color, the yard’s slope, or the location. If each prospective tenant has seen the sign, they have also seen the home, the yard, and the neighborhood.

Your for-rent sign should have a phone number that goes to a voicemail box; never give your personal phone number to your tenants. This voicemail should have a message that explains any details about the house, such as the number of bedrooms and bathrooms. Give as much information as possible because you aim to have the prospect hang up if the house is unacceptable. You want to reduce the showings to candidates who will not like the place.

Your voicemail message should end by giving the time of an open house. It’s best to set up several open houses at different times to accommodate the candidate’s schedule. You are there to answer questions at the open house, but there is no need to walk each person through the house. Let them walk around independently, and be ready with an application if they like the home.

This approach will limit the time you speed finding a tenant to a few hours. After several applications, you must pick a tenant and sign a lease. After that, all you have to do is maintain the property and collect the rent.

3. Maintain the Property

Don’t do the work yourself.

The primary role of the landlord is to maintain the property by doing routine maintenance and handling repairs. This maintenance will include any necessary repairs to the rental house, such as fixing leaky pipes and repairing faulty electrical systems. Depending on the local regulations and the lease, the landlord may also have to repair or replace broken appliances.

Our goal is to reduce the time and hassle with the rental property. You should never do even the most minor maintenance work yourself. I must stress this point; no matter how handy you are, it is best never to do any maintenance work yourself.

For maintenance calls, you should set up another voicemail-only phone number. These numbers are available at a very low cost, and sometimes a Google number is free. Your tenant should leave a description of the problem as a voicemail, and you use this voicemail to call a contractor to handle the situation. Have the contractor call the tenant directly to schedule the work, and your time commitment drops to a few minutes.

At first, it may seem strange that you are not talking to your tenant. Be sure to explain this to them when signing the lease. It’s simple to explain that this resolves the problem quickly because multiple people can respond to the call. In addition, it reduces problems with you accurately describing the issue to the professional. I’ve never had a tenant object to this as long as the work gets done quickly.

Don’t be a slumlord. The process is reducing your involvement, but it is still essential to handle repair and maintenance obligations quickly. Managing these issues is your primary role as a landlord, and it makes it easier to collect the rent.

4. Collect the Rent

Let the rent come to you.

Set a definite due date for the rent, and never have a grace period (if legally allowed). The grace period serves no purpose other than encouraging a tenant to pay late. You should change the due date if you want the tenant to have extra time. To manage rental property effectively, you must collect the rent promptly.

Set up a mailbox for the tenant to send the rent, and provide them with pre-addressed envelopes to that mailbox. At the lease signing, explain that the rent must be in the box on the due date, so it should be mailed early. You don’t want to hear “the check is in the mail” and not know if that’s true. Avoid that by insisting rent be received by the due date.

As an alternative to the mailbox, you can choose other automated means such as Cash App or Venmo. You should never meet with a tenant to collect the rent. Always have the rent come to you without tenant interaction. Collecting rent is easy, but eventually, you will need to deal with non-paying tenants.

5. Deal with Non-Paying Tenants

If the tenant isn’t paying, get them out fast.

If you do this long enough, a tenant will inevitably miss a rent payment. Remember that the rules in each municipality are different, so use this as a general outline while adhering to local laws and regulations.

- If the rent is not received on time, the very next day, you should send a letter demanding payment within five days. If legally possible, word this letter to serve as an eviction notice (often called a demand letter).

- If rent is unpaid, file for eviction as fast as legally possible in your jurisdiction. Many cities have online options for initiating the eviction process. Remember, you can always stop the eviction if they pay, but the eviction fee should be added to their balance. The most compelling collection call is the sheriff tacking an eviction notice to the door. In most cases, the tenant pays after this.

- In cases where the tenant has not paid rent, let the eviction go through. You must get a non-paying tenant of the house as fast as possible.

Your objective is to avoid talking to the tenant and falling prey to their story. The only relevant fact is the rent wasn’t paid; the reason it wasn’t paid does not matter. If you want to work out a payment plan, I suggest you still start the eviction, and I explain why in my guide for dealing with non-paying tenants.

6. Tenant screening

Tenant screening is a critical aspect of managing rental properties for real estate investors. Finding suitable tenants who can uphold their lease agreement, provide consistent cash flow, and maintain the property’s condition is crucial for long-term success.

- One of the initial steps in tenant screening is collecting rental applications from potential tenants, which should include necessary information such as employment history, references, and financial details.

- Conducting background and credit checks allows landlords to assess the applicant’s credibility and determine their ability to meet their financial obligations.

- Verifying income and employment stability provides insight into the applicant’s ability to pay rent consistently.

Another important consideration is the collection of security deposits, which safeguard against any potential damages or unpaid rent. Real estate investors can significantly minimize the risk of problematic tenants and ensure a stable and profitable rental business by implementing a thorough tenant screening process.

7. Legal Compliance

Legal compliance is an essential aspect of rental property management for both property owners and property management companies. Adhering to best practices and understanding the applicable laws and regulations is crucial to protect tenants’ rights and ensure a smooth operation of the rental property business.

- One key area of legal compliance is establishing fair and reasonable rental policies, including late fees and rent payment procedures.

- Rental owners and rental property managers should familiarize themselves with local landlord-tenant laws, such as fair housing laws, to avoid legal action or discrimination claims.

- Property owners are responsible for fulfilling their legal obligations, such as timely property tax payment and proper maintenance and repairs. -Routine inspections help identify any maintenance issues and ensure the safety and habitability of the rental property.

By maintaining legal compliance, rental property owners and managers can build good relationships with tenants, foster a positive rental experience, and operate their real estate business with peace of mind.

8. Reduce turnover

One of the primary goals for rental property owners, whether they are first-time landlords or experienced investors, is to reduce tenant turnover. High tenant turnover can be time-consuming, financially draining, and disrupt day-to-day operations.

- To achieve long-term success and maintain a steady cash flow, landlords should focus on attracting and retaining quality tenants.

- Conduct thorough background checks and screening during the rental application phase. This helps ensure new tenants have a good credit score and rental history and can responsibly meet their rent payments.

- Provide prompt responses to maintenance requests and address concerns in a timely manner.

- Consider offering incentives such as rent reminders, convenient digital payments, or the option for renters insurance.

Building trust and being an attentive and responsible landlord creates a sense of value and encourages tenants to stay long-term. By implementing these strategies, a landlord can reduce tenant turnover, minimize vacancies, and establish a strong reputation as a successful and reliable property manager.

9. manage expenses

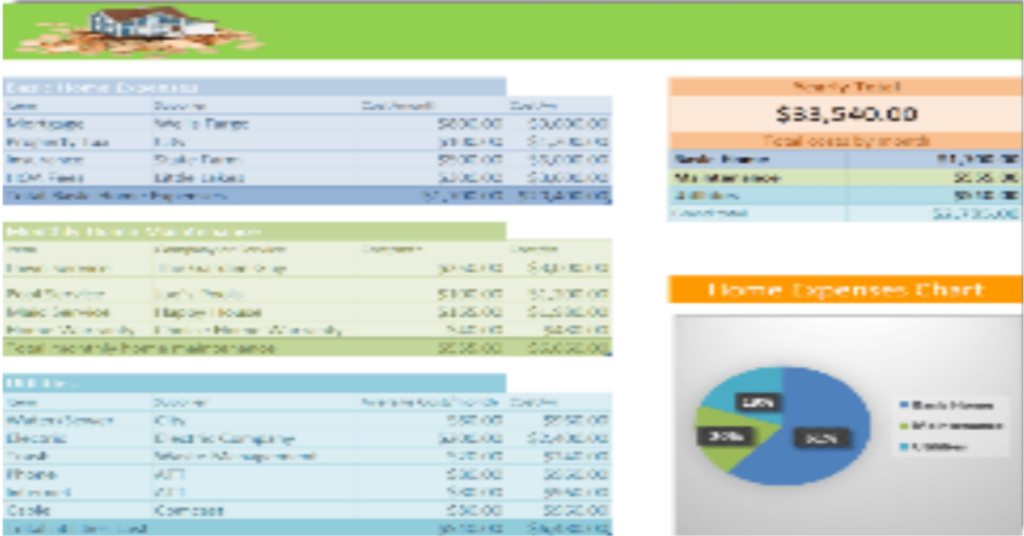

Owning rental property is expensive. You will spend about 40% of the rent on expenses, and that doesn’t include mortgage payments.

Effective expense management is crucial to owning and managing rental properties, whether you’re a first-time landlord or an experienced investor. Finding a good way to balance expenses and income is critical to maximizing profitability and ensuring long-term success in the real estate market.

A comprehensive analysis of your expenses and budgeting is an excellent first step. This includes identifying regular expenses such as property maintenance, property management fees (if applicable), insurance premiums, property taxes, and utility costs. Keeping track of these expenses regularly helps you stay on top of your financial responsibilities and maintain a healthy cash flow.

Maintaining a separate bank account for your rental property business is a good idea to ensure accurate financial tracking and to keep personal and rental funds separate. This allows you to monitor income and expenses related to your rental property easily and simplifies tax reporting during tax season.

Regularly reviewing your expenses and seeking cost-saving opportunities is essential. For instance, exploring competitive quotes from contractors for maintenance and repairs can help you save money in the long run.

By effectively managing expenses, diligently monitoring income and costs, and making informed financial decisions, landlords can optimize their rental property business, achieve financial stability, and work toward long-term profitability.

10. Contractor network

Building a reliable contractor network is an essential step for landlords to address maintenance issues in a timely and cost-effective manner efficiently. Look for property maintenance contractors with experience working with rental properties.

Networking with other landlords, property management services, or experienced property managers can be a great way to gather recommendations and referrals for reliable contractors. Sharing experiences and collaborating with professionals with a good industry reputation can help you find trustworthy contractors who align with your best interests.

Creating a list of preferred contractors for different types of repairs and maintenance needs is a good practice. This allows you to identify the right professional for each specific task easily and ensures you have multiple options, reducing the risk of delays or unreliable services.

Establishing clear expectations and communication channels is essential when engaging contractors. Clearly define the scope of work, expected timelines, and payment terms in written agreements or contracts.

Building a long-term relationship with reliable contractors is beneficial as they become familiar with your property and its unique maintenance needs. They can provide valuable advice, recommend preventive measures, and offer competitive pricing for their services.

Avoid getting comfortable with a single contractor. While relying on a trusted contractor for all your maintenance and repair needs may be convenient, it can lead to higher costs in the long run. Without seeking competitive bids, contractors may not feel the need to offer their best prices, resulting in inflated charges for services rendered.

By investing time and effort in building a solid contractor network, landlords can save much time and stress when it comes to property maintenance and repairs. Having trusted professionals readily available contributes to the efficient management of your rental property, helps maintain tenant satisfaction, and ultimately supports the long-term success of your real estate investment business.

11. Tenant Communication

Establishing open and effective communication channels with your tenants is crucial for maintaining a positive landlord-tenant relationship and ensuring smooth day-to-day operations. Good tenant communication contributes to tenant satisfaction, reduces misunderstandings, and facilitates prompt resolution of issues that may arise during their tenancy.

From the moment a new tenant is approved, initiating clear and concise communication is essential. Introduce yourself as the landlord and provide them with important information such as move-in procedures, lease terms, rent payment methods, and contact details for maintenance requests or emergencies.

Throughout the tenancy, maintain regular communication with your tenants to address their concerns, provide updates on property-related matters, and foster a sense of community. Promptly respond to their inquiries through email, phone, or in-person meetings, and ensure that communication is conducted professionally and respectfully.

When it comes to important topics such as rent reminders, lease renewals, or any policy changes, provide advance notice to tenants to give them ample time to prepare and adjust accordingly. This proactive approach helps avoid misunderstandings and ensures transparency in your landlord-tenant relationship.

Tenant communication should also extend to maintenance requests. Establish clear guidelines on how tenants can report maintenance issues through an online portal, email, or phone and provide a reasonable timeframe for addressing their requests. Regularly update tenants on the status of their requests and ensure that repairs are handled promptly by qualified professionals.

Effective tenant communication is an essential aspect of managing a rental property. By fostering open and transparent communication channels, responding promptly to inquiries and maintenance requests, and keeping tenants informed, you can establish strong relationships, promote tenant satisfaction, and create a harmonious environment in your rental property.

Conclusion

Learning the details of property management is essential for a rental house investor. To build an extensive portfolio, you must learn how to manage the rental property yourself. After you grow, you may want to hire an employee to help manage the properties, but never use a property management company.

You can easily manage your rental properties yourself by following the steps outlined in this article. Make sure you set a fair market rent, market the property to find tenants, handle maintenance and repairs, collect the rent, and handle tenants that don’t pay. It’s that simple, and this article has explained each step in detail.

If you are just starting out, read my ultimate guide to buying your first rental house.