Learning how to set market rent is a skill that every landlord needs to master. In fact, setting fair market rents is one of the first challenges a new landlord has with their rental house. That is a complicated process, but the best property managers follow these steps.

- Find comparable properties in the same area that are currently for rent.

- Reduce this list of comparables until it only includes properties with square footage and the number of bedrooms and bathrooms similar to your property.

- Calculate the average rent for the comparables.

- Adjust the average rent price based on any unique amenities that your property offers.

These steps are simple to follow, and the challenge comes from accurately identifying comparable homes. Identifying the correct comparables is an essential skill that you must cultivate to manage rental properties effectively. The article will explain the best way to find these comparables, and to use them to set your market rent.

What is Market Rent?

Market rent, as defined by Law Insider, is the amount of rent that can be expected for the use of a property in comparison to similar properties in the same area. This is generally considered the amount of rent qualified tenants are willing to pay and that landlords of comparable units are willing to accept. The fair market rent will vary between cities, neighborhoods, and even by the block. The rental price will also vary based on house size, bedroom count, and many other factors.

Any successful property management company knows that when they have a property for rent, the best way to fill the vacancy is by determining the fair rental value in the local market. These property managers understand that the right rent price will reduce vacancies and increase revenue. The hard part is knowing how to set market rent, which I will show in this article.

Why Should Landlords Know the Market Rent?

While it may be nice to get excess rent on your property, all your decisions should be based on the market rent. In exceptional cases, you may be able to get rent above the market rate, but you should never rely on this to make a deal work. It is important that you learn how to calculate rental rates, and set the appropriate rent.

Attracting Tenants

Using the market rental rate will help a property owner attact good tenants when advertising the property. You don’t want to start with low rent and then need to raise the rent on existing tenants to cover your expenses. On the other hand, it will be challenging to find a tenant if you ask too much for rent.

As a landlord, if you have a new rental property in line with other properties in the neighborhood, your occupancy rate should be nearly the same as other standard quality units in the area. If your occupancy rate is much better than comparable rental properties, it’s a sign that your rent is too low; you could get higher rental rates.

On the other hand, if your vacancy rate exceeds that of the local rental market you are probably charging too much rent. This will turn away potential tenants as nearby rental units would be available for the fair market rate.

Keeping Tenants

Later, when you have a long-term tenant, knowing the market rent will help you decide if it’s time for a rent increase. If you arbitrarily raise the rent at lease renewal, to an amount which is greater than the market value, your tenants can find similar houses at a lower cost. This increases the chance that the tenant will leave, and you will end up with a vacancy. If you keep the rent artificially low, you may have problems paying the property taxes or making timely repairs.

In cases where you plan to charge more or less than the market rent, you must have a baseline from which to deviate. When analyzing the purchase of investment property, you must know the market rent to forecast revenue. Market rent is one of the most critical metrics for a rental property, and accurately discovering market rent is a valuable skill that real estate investors must master. In the end, you’ve done something wrong if you can’t get the market rent. After all, by definition, market rent is the amount you can get.

How Can You Determine the Market Rent?

The goal of determining market rent is simple; determine what similar properties in your area are renting for. Determining the actual market rent is more complicated. To do that, the landlord must do a rental market analysis to zero in on the market rent by checking nearby rentals offered for rent. This comparative market analysis for your rental house evaluates the rent amounts of similar properties that have recently been rented or are currently on the rental market. Remember that it’s essential to use data from similar properties, not just any nearby rentals.

Zillow

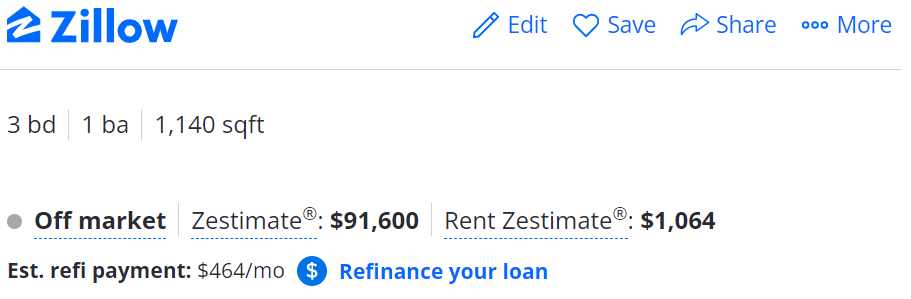

A good starting place for finding the market rent is Zillow, which uses an algorithmic approach for estimating rents. Put simply, this means using formulas and existing data to determine what the market rent should be. Zillow will attempt to calculate the correct rent amount but will also give you a range of rents based on its formula. Ocassianly this value is off because of external factors that the algorithm is unaware of. In rare cases, the Zillow rental value may not exist, and you will need to use one of the other methods.

It’s simple to get the rent amount from Zillow. You type in the property address, and Zillow will show you the rent amount.

The Zillow rent estimation will give you a general idea of what similar houses rent for. It can be easily used to disqualify a property if the rents are far from what is needed for the deal to work. If the number is close to a deal, continue with the other methods to zero in on actual market rent. Keep in mind that sometimes Zillow is skewed by an outlier.

Check Competitors

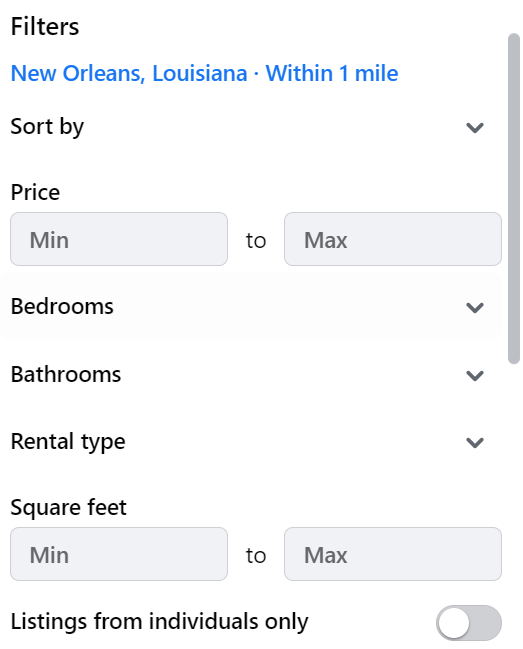

When you are new to an area, you should check the asking rent for other houses. This is simple to do online with tools like Facebook MarketPlace.

When using the Facebook marketplace to find rental comps, narrow the search as tight as possible. Sometimes a rental listing in the next neighborhood rents for many times what your target property will rent for. In addition, use the filter to ensure you look at similar square footage and the same number of bedrooms and bathrooms. Remember, comps are comparables, so you want to find the houses that most resemble your target property.

Other sites, like rent.com, apartments.com, and realtor.com, can provide a similar service. I suggest trying them all out; the more data you have, the more accurate your number will be.

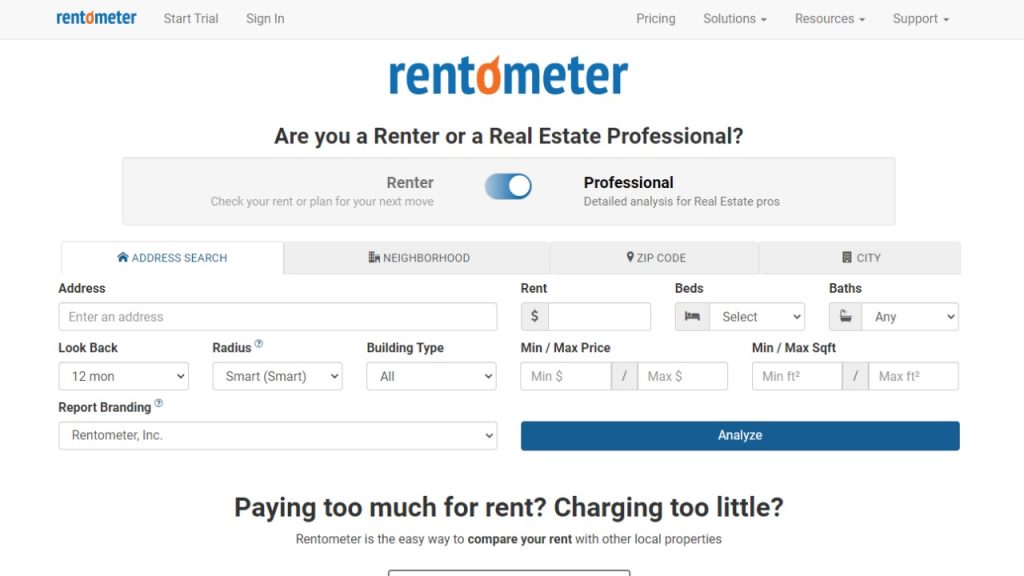

Rentometer

Rentometer is a paid service that helps determine current market rent. This is more robust than other options and doesn’t require you to search by address. You can search by neighborhood, zip code, and city. In addition, rentometer will allow you to set specific property attributes such as the number of bedrooms and bathrooms.

The rentometer market price calculator allows you to do a few searches for free, but after that, you have to sign up. They offer 3 product tiers with the lowest costing $49 per year.

Know The Area

The best way to know market rent is to understand the area already. It will take some time, but once you have done this for a while and have a few rentals in the same area, you will know what the rents are. Hopefully, you have followed my advice about getting the maximum rent and instantly understand what a house can get in the area you work.

If you come across a lead in an area with several rentals, you will already know the current rent and can make a purchasing decision faster. Soon you will get to the point where you don’t need to check the other sources. This is especially true when you have similar houses with the exact bedroom/bathroom count and square footage. You can always use the methods above when deviating from your area, but investing in a local area you know is one of the best ways to safley buy rental housing.

How I Determine Rent

When I know the area, I use that knowledge first. I still check Zillow as a sanity check on my number and to note areas where the Zillow value may be skewed. Then I’ll check out what competitors are asking to ensure I haven’t missed a market change. If I have to go outside of my area of expertise, I determine rent using the methods above.

Conclusion

Understanding how to accuraelty set market rent is essential. It allows a landlord to maximize rental income, avoid vacancies, and remain competitive. The article discusses the importance of setting fair market rents for rental properties and outlines steps to follow. Real estate investors must learn how to identify comparable homes accurately, and this article provides several methods for determining market rent. These methods include using Zillow, checking competitors, and using Rentometer.

The article also explains why landlords should know the market rent and how it can impact their decision-making regarding rent increases and property management. This article described how to set market rent. I have written a comprehensive guide for investing in rental units, and it expands on this topic.