On January 12, 2023, I signed a contract to purchase the house and closed on that house on January 26; that’s 14 days. I pushed for it to happen faster, but the seller was slow in responding to the attorney. This deal involved a real estate agent, which slows down the process because you don’t have direct access to the seller.

Funding

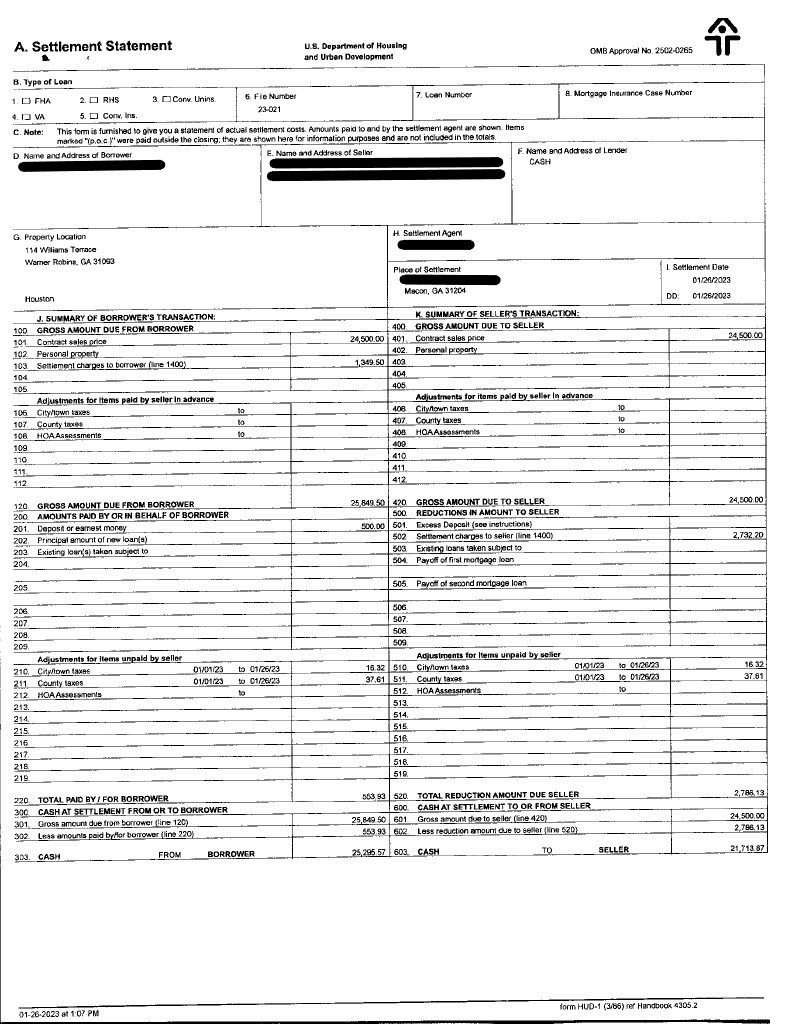

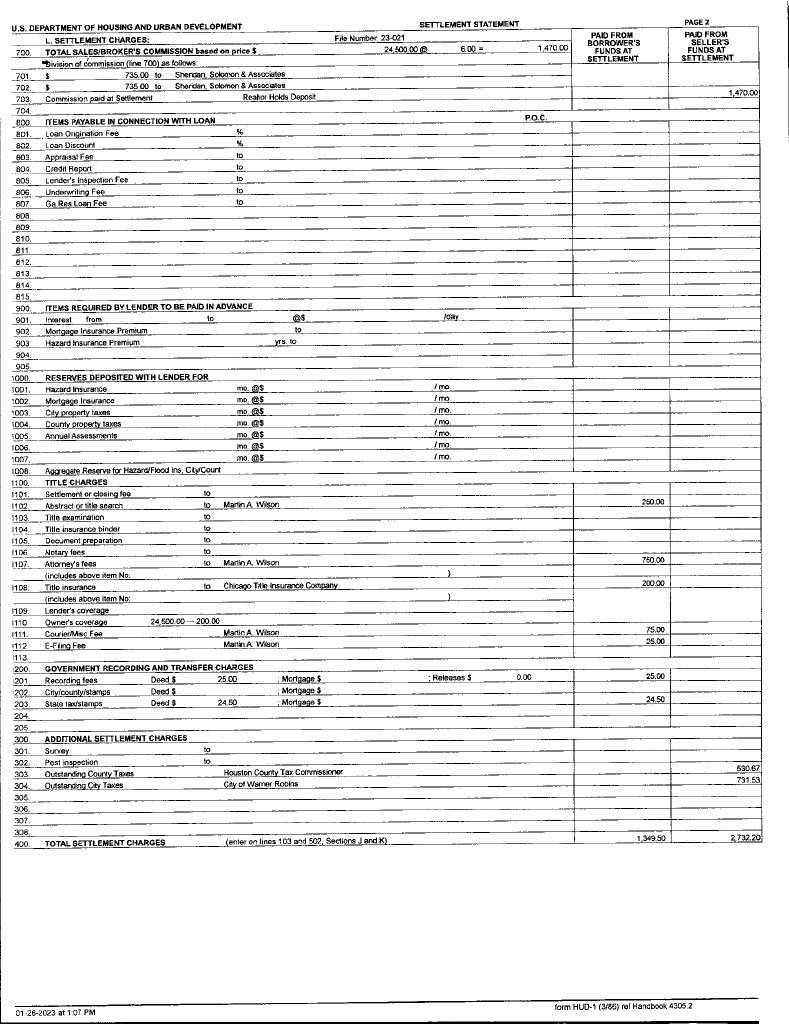

I paid $24,500 plus closings for this property, a total of $25,849.50. I paid cash for it and will likely fund the repairs with cash.

Approach

I expect to spend a total of $65,000 by the time this house is ready. It will rent for $1,150, which means I will have spent 56 times the rent. This will not work under my plan of never paying more than 50 times the rent. If you don’t know how I came up with that number, read my article that teaches how much to pay for a rental house.

Because this will not work as a rental, my goal will be to flip this house. I should be able to sell it for $106,000, which means I will be in the house for 61% of the after-repair-value (ARV). For flips, my general goal is to be under 70% of the ARV. Therefore, this property will make a good flip candidate. I prefer to add to my rental portfolio, so if I can find a way to complete the job for under 50 times the rent, I will keep it as a rental.

Conventional wisdom says you can pay more for a rental property than a flip. It is common to say that buy-and-hold investors can pay a higher amount, but I think this is incorrect. You will have difficulty generating a positive cash flow if you go much above the 50 times rent threshold. In time, rents may rise to help you, but it’s better to sell the house and take an immediate profit.

I am skeptical of that $106,000 value I put on the house. I got that value from PropStream. My real estate agent thinks it will sell for $110,000, and a colleague says it could go as high as $120,000. I prefer to go with the lower value when making a purchase decision, but I’ll try for the higher value when it’s time to sell. Many in the industry expect home values to drop in the next few months.

Next Steps

I have closed, so the next step is to start the renovation.

Update: The Renovation Begins.

Artifacts

Below is the HUD-1 form from this sale.